Welcome to May’s update from our friends at Saxco, on market dynamics in beverage packaging.

This update first appeared as a paid subscriber feature in the Ciatti California Report on 14 May. If you are not yet a paid subscriber and would like full access to the monthly California Report, its actionable bulk wine and grape market intelligence, bulk inventory charts by volume and by varietal, and bulk/grape market activity barometer, you can check out our subscription plans by clicking below.

In recent years, US trade policy developments – including broad tariffs and anti-dumping/countervailing duties – have disrupted global supply chains and increased costs across multiple industries. The wine and spirits sector, in particular, continues to experience the ripple effects of trade tensions involving key packaging sources such as China, Mexico, and Canada, along with ongoing tariffs on aluminum and steel.

On April 2, 2025, President Trump invoked emergency trade powers under the International Emergency Economic Powers Act (IEEPA), imposing a 10% “baseline” IEEPA tariff on most imported products from most countries, effective April 5. Higher tariff rates on imports from 57 countries were temporarily suspended for all but China, providing a 90-day reprieve. Meanwhile, China was subjected to 125% IEEPA reciprocal tariffs plus 20% IEEPA “fentanyl” tariffs, as well as any other applicable tariffs, such as the 25% China Section 301 tariffs initially imposed during President Trump’s first term.

On May 12, the US and China agreed to a 90-day reduction in tariffs, effective May 14. This will reportedly result in a reduction to U.S. IEEPA reciprocal tariffs on Chinese goods from 125% to 10% but not affect the 20% IEEPA fentanyl tariffs or other applicable duties. China's tariffs on US imports will reportedly fall from 125% to 10%, also effective for 90 days.

Despite this short-term tariff relief, significant US trade restrictions remain in effect, including alternative 25% duties on steel, aluminum, and automobiles, as well as alternative 25% tariffs on Canadian and Mexican products that do not meet the origin requirements under the US-Mexico-Canada Agreement, or USMCA.

While financial markets responded positively to the immediate easing of tariffs – with major indices seeing temporary gains – long-term business confidence remains fragile amid ongoing uncertainty. Federal Reserve Chair Jerome Powell has cautioned about potential stagflation should trade instability persist. Additionally, JP Morgan estimates sustained tariffs could negatively impact global GDP by up to 1%.

Tariff implications for the wine industry

Given this persistent volatility, the wine and spirits industry remains cautious, proactively recalibrating supply strategies. Businesses are encouraged to carefully evaluate their exposure to supply disruptions – especially from China, Mexico, and Canada – and implement measures such as securing long-term contracts, maintaining safety stock, and identifying alternative supply channels in collaboration with their packaging partners.

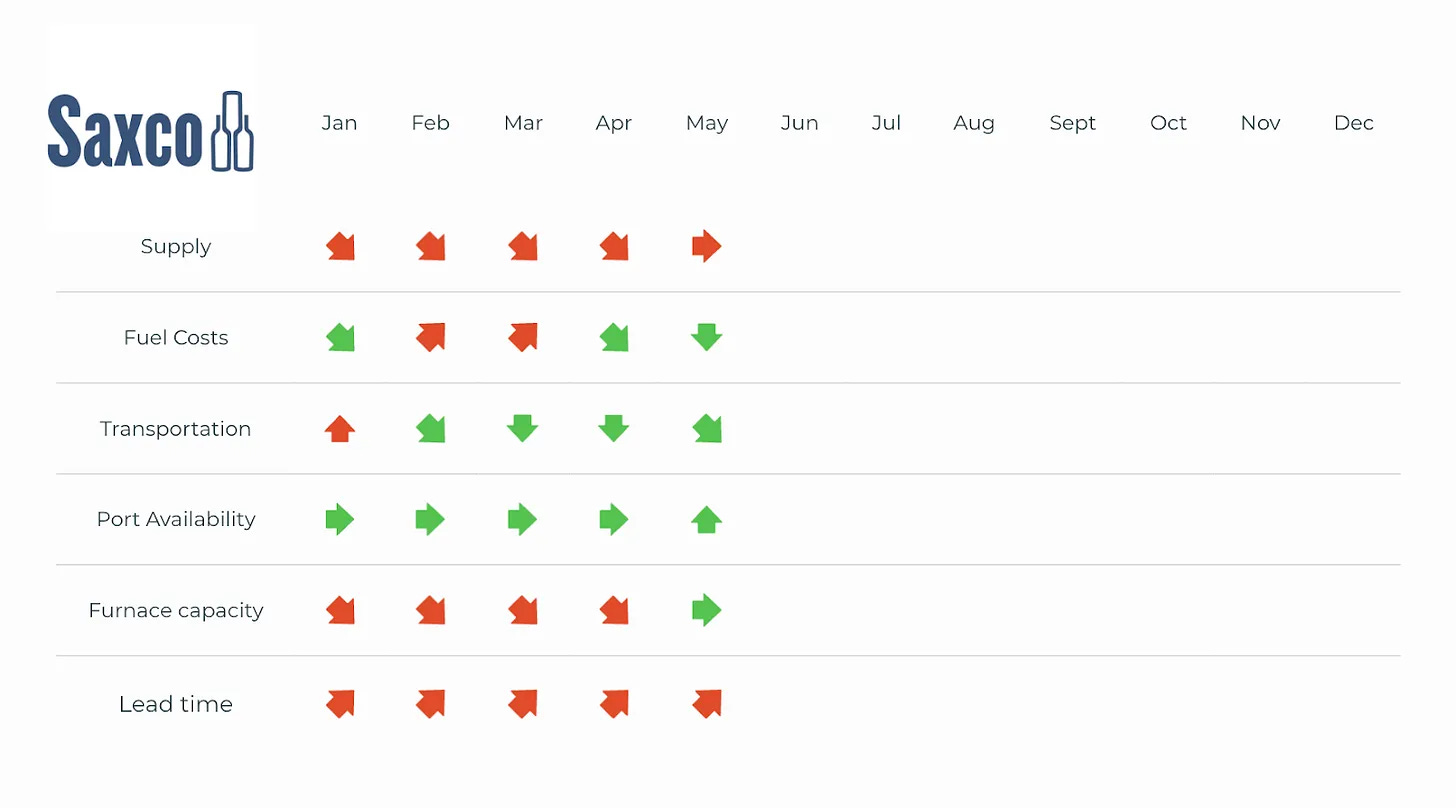

The monthly changes across key channels are still fairly stable; however fuel costs are slightly down with US diesel lower from $3.585 in March to $3.567 in April. We anticipate increases starting in May as we approach the summer months and on the heels of some refinery closures and maintenance. We also see some port availability and lower transportation costs as a result of lowered imports from China.

Bottled Tidbits – For most of history, glass was a fragile instrument we drank from or looked through – whether it be a window, a set of reading glasses, or a television. It always needed some level of durability but did not require the everyday strength of clumsy humans using it for almost five hours a day. Then came the smartphone, and everything changed.

The moment we started putting glass in our pockets – expecting it to survive keys, curbs, and concrete – scientists had to rethink everything they knew about strength, flexibility, and resilience. And so began one of the most remarkable chapters in material science.

Enter Gorilla Glass, a sleek, nearly invisible armor forged by Corning. Designed to resist drops and scratches, its toughness is due not just to science but also to a stunning manufacturing process. Using a technique called fusion draw, molten glass flows like honey and forms whisper-thin sheets as it cools mid-air – a breathtaking balance of heat, gravity, and precision.

But then the glass plunges into a molten salt bath, heated to around 400°C to make the magic happen. This isn’t spa treatment – it’s ion exchange, where tiny sodium ions inside the glass are pushed out and replaced with bigger, brawnier potassium ions. The result? A layer of internal tension that gives the glass its almost supernatural strength.

And when you think the story can’t get more sci-fi, along comes AM-III – the world’s hardest glass. Scientists created it by crushing carbon fullerenes, then applying intense heat and pressure – 1,200°C and 25 gigapascals, to be exact – for twelve hours straight. Then they let it cool. The result? A clear, durable glass that can scratch a diamond.

This isn’t just about better phone screens – these breakthroughs open doors in solar energy, aerospace, and protective tech. What started with a cracked phone screen has turned into a quiet revolution – one in which everyday glass is becoming smarter, stronger, and almost indestructible. It also is almost as efficient as silicon to conduct electricity. So the next time you tap your screen or glance through a window, remember: you’re looking at centuries of invention – and a future that’s still being shaped, one atom at a time.