Welcome to June’s update from our friends at Saxco, on market dynamics in beverage packaging.

This update first appeared as a paid subscriber feature in the Ciatti California Report on June 12. If you are not yet a paid subscriber and would like full access to the monthly California Report, its actionable bulk wine and grape market intelligence, bulk inventory charts by volume and by varietal, and bulk/grape market activity barometer, you can check out our subscription plans by clicking this button.

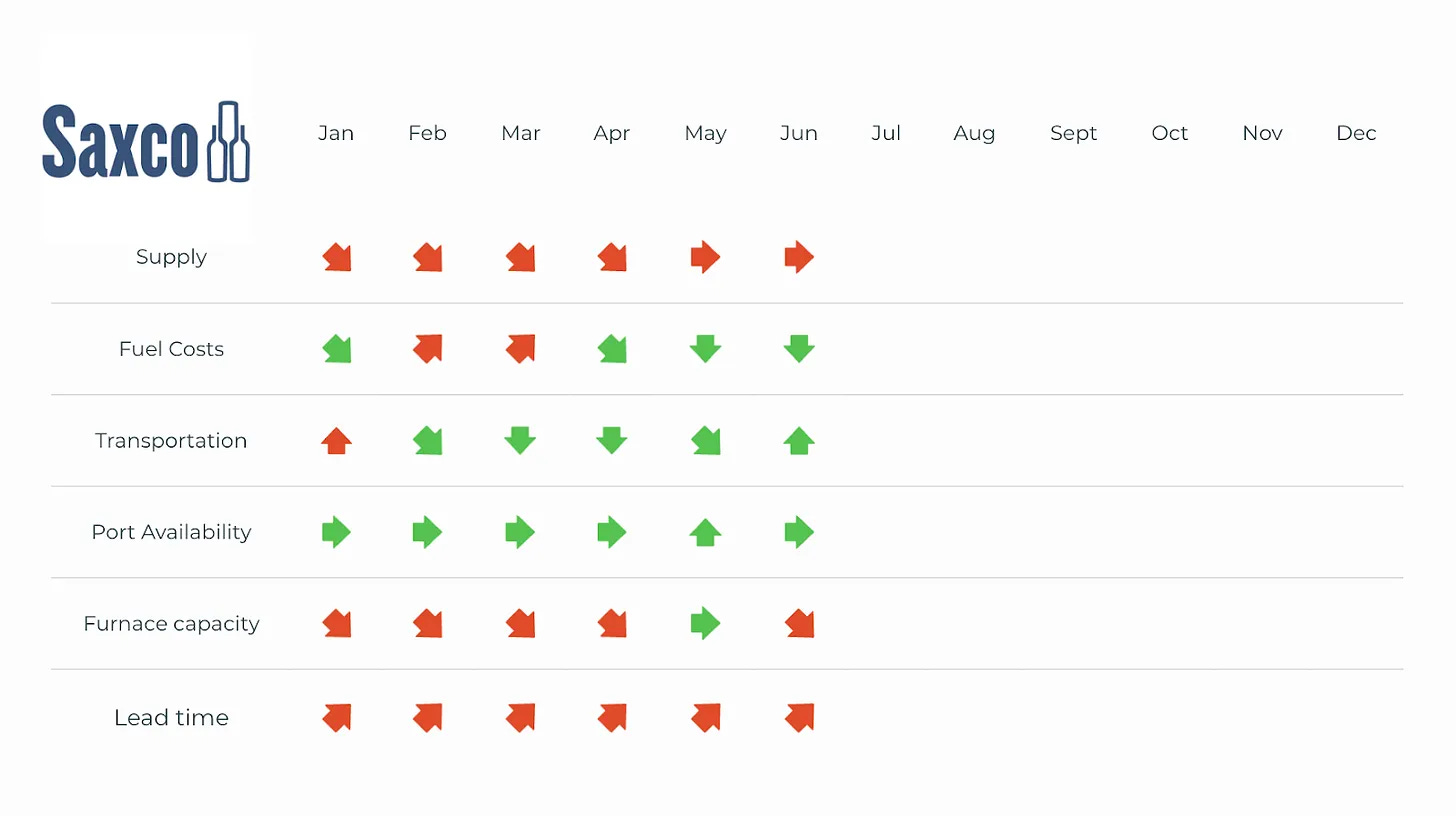

As we move into the summer shipping season, the overall supply chain remains relatively stable – though a few indicators are beginning to shift. Here’s what we’re seeing across the key areas impacting glass packaging and logistics.

Glass supply is holding steady, with no significant disruptions reported across domestic or international sources. Availability has remained neutral for several months now, though specific bottle types and molds still see some intermittent constraints. That said, there is a growing awareness in the industry of potential pressure on furnace capacity later this year. Conversations are underway about potential closures in Q4, which could result in tighter availability in early 2026 if demand remains stable or increases.

Diesel prices edged downward in May, offering slight relief for overland freight. The national average fell from $3.567 per gallon in April to $3.499 in May. This small but welcome drop comes at a time when other transportation costs are trending in the opposite direction.

Ocean freight, particularly from Asia to the US, is climbing quickly. Rates on both West and East Coast lanes have risen sharply since last month. Peak Season Surcharges (PSS) went into effect on June 1, with another increase already scheduled for mid-month on June 15. This adds new cost layers to international shipments as import activity ramps up ahead of Q3 programs.

Despite this, US port availability remains neutral. Terminals are functioning within expected capacity ranges, and there are no significant bottlenecks at the time of this writing. Still, any surge in freight driven by the PSS or forward-buying in anticipation of future tariffs could strain throughput later in the quarter.

Lead times continue to trend upward, particularly for custom molds and anything involving multi-step international sourcing. While the situation hasn’t worsened since May, extended planning windows remain necessary across most categories.

In the background, there’s growing attention on trade policy signals -particularly around the Trump campaign’s proposal for new tariffs on steel and aluminum. While these policies haven’t been enacted, the potential for sweeping import duties has already triggered concern within the industrial packaging sector. Glass may not be directly targeted. Still, tariff-related input costs and manufacturing equipment pricing could be affected, especially if the policy environment shifts again.

For more detail, the Council on Foreign Relations has published a helpful summary: Trump’s New Aluminum and Steel Tariffs Explained.

Bottled Tidbits - According to ancient legend, the first glass was made by accident. Around 3,500 BCE, Phoenician merchants shipwrecked on the Levantine coast built campfires on the beach using blocks of natron (a type of mineral salt) from their cargo. As the fire burned, the heat fused the natron with sand, forming puddles of a strange, glassy substance. This early proto-glass wasn’t yet what we’d call bottle-grade - more glaze than a vessel - but it kicked off centuries of experimentation.

From those fiery beginnings, glassmaking evolved across Egypt, Mesopotamia, and eventually Rome, where techniques such as blowing and molding transformed glass into a functional - and ultimately indispensable - material. A happy accident became a cornerstone of civilization.