Welcome to the June update from our friends at Saxco, on market dynamics in beverage packaging. This update first appeared in June’s Ciatti California Report, which you can find on Substack here.

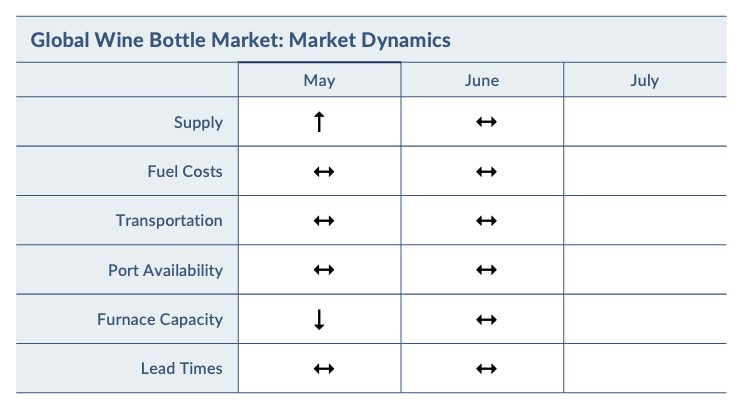

Market Dynamics

The market is still stable, but a major event has occurred that could potentially have significant implications for the glass market.

On December 29, 2023, a petition was filed alleging that imports from Chile, China, and Mexico are unfairly traded and injure the US glass bottle industry. The petition has led to investigations by the US Department of Commerce and the US International Trade Commission.

Commerce is assessing whether imports from China receive unfair government subsidies and whether imports from all three countries are being sold in the US below fair value (i.e., whether the imports are being “dumped”). The ITC will determine whether these imports injure or threaten the domestic glass industry.

On May 29, 2024, Commerce announced its affirmative preliminary determinations of subsidies and critical circumstances in the Glass Wine Bottles from China countervailing duty (CVD) investigation. The preliminary subsidy finding means that, going forward, importers of in-scope glass bottles from China will need to pay cash deposits ranging from 21.14% to 202.70% for as long as the preliminary CVD measure is in place and are liable for any permanent CVD duties that subsequently may be found to apply to such imports. The preliminary finding of “critical circumstances” means that importers who imported in-scope glass bottles from China after March 5, 2024, which is the 90-day period preceding the publication of the determination, are similarly responsible for the payment of cash deposits to secure CVD duties on imports during this additional retroactive reach-back period.

Moreover, Commerce is expected to announce preliminary antidumping (AD) determinations on imports from Chile, China, and Mexico on or about July 29, 2024. If affirmative, these rulings will impose additional cash deposit requirements, and they may also apply retroactively.

Following the preliminary rulings, Commerce will issue final CVD and AD determinations, potentially altering the cash deposit rates. If the ITC makes affirmative final injury determinations, duties will be imposed for at least five years. The investigations will be terminated if the ITC makes negative final injury determinations.

This could possibly have major tax implications for companies that have purchased glass from China, Mexico, and Chile. Moreover, if affirmative, this may significantly impact domestic bottle pricing and availability.

Packaging Trends

Key Insights

Ocean freight has increased: The cost of shipping from Asia to the US West Coast is now $6,000+ per container, up from around $2,000 per container previously, and the cost of shipping from Europe to the US East Coast is now $5,000 per container, up from around $4,000 per container previously. The drivers for this increase are an unexpected increase in freight demand and the Red Sea diversions.

Ultimately, the countervailing (CV) and antidumping (AD) initiatives could significantly impact bottle pricing and availability in upcoming months and have financial implications for wine and spirits companies.