Ciatti California Report - September 2024

Crop appears lighter in some areas; grape market activity still limited

Following an easing of heat levels in mid-August, 100-105°F temperatures returned to some areas of California toward the end of the month and into the first week of September. Reports of the hottest summer on record – for the western US as well as the Northern Hemisphere as a whole – obscure a more nuanced picture at the local level: While heat has been consistently intense in California’s southern Interior, Coastal areas have tended to avoid the worst extremes and, in some cases, even experienced cooler-than-average August temperatures. It has, in general, been a good growing year.

The picking timetable is well in advance of last year – when it was delayed by unusually mild conditions – and close to normal, with harvesting of the early whites getting started in the Interior by mid-July and in the Coast at the beginning of August. The return of higher temperatures has likely quickened the pace somewhat: Brix levels are now approaching their optimum even on some later-season reds and, as such, varietal readiness may coincide, potentially leading to processing bottlenecks. We are yet to hear of any such issues, however, and crush capacity in general appears to be more than adequate.

In the North Coast, the white grape harvest is in full swing and picking of some earlier reds is just underway. Performance appears to be spotty, with – so far – Mendocino and Lake counties seeing average to above-average crops in general, and Sonoma and Napa average to slightly-below average crops. In the Central Coast – where the Sauvignon Blanc harvest is well underway but picking of Chardonnay is only just getting started – there is a suspicion the crop will reduce in size from north to south; some early results have been lighter than average. The Coastal crop in total can be characterized as looking average to slightly below average in size. In the Interior, the white-grape harvest is moving toward completion and – with Brix levels approaching optimum – the main body of the red-grape harvest is underway. White grape tonnages are down, with estimations of the shortfall at perhaps 15-20%.

Given the slowness of the state’s grape market this year, and an understandable reluctance to custom crush due to the bulk market’s similar slowness, grapes are likely to be left hanging, making it even more difficult – this early – to estimate a state-wide crop size. As we reported last month, some testing for smoke exposure is being conducted by wineries. It remains early in this process, and data is somewhat limited, but we have heard of elevated numbers in some areas of the state where early-season wildfires occurred.

Away from harvest, the wait goes on for better case-good sales numbers. Consequently, the bulk wine and grape markets remain largely characterized by slow activity levels and relatively low prices. Read on for the market latest and – for the most up-to-the-minute intel – get in touch directly with the Ciatti broker team, able to draw on over 130 years of collective wine industry experience to help buyers and sellers navigate this challenging period for the industry.

To read the full report, simply keep reading below, clicking on images to enlarge them. For Ciatti head office and individual brokers’ contact details, hit this button.

The Grape Market

The spot market for 2024 grapes has continued to be exceedingly slow. With bulk wine demand still sluggish, and an understandable hesitation to incur costs on holding wine when the chance of a timely return appears limited, many wineries have been conservative when quantifying their grape needs. Wineries will wait for the picture on 2024 yields – in their own vineyards and in others – to crystalize, but they suspect that, if they require it, uncontracted fruit will still be available late in the season.

The initial, tentative signs of a lighter-than-average crop – in some areas at least – suggest there may be a danger of overestimating late-season grape availability. Another factor wineries must bear in mind is harvest rapidity: If the latest heatwave speeds-up and condenses picking, the window of opportunity for assessing grape needs and securing extra fruit may close quickly. But many wineries will likely need more evidence of the need for grapes before moving and, in any case, they may prefer to err on the side of going short, perceiving that they will be able to secure bulk wine instead. As we talk to growers, we see that their optimism is understandably wearing thin: Earlier in the year, there was still time for uncontracted grapes to find a home, but now, with harvest underway, time is rapidly running out.

Growers are increasingly casting a wide net for potential late buyers, and are open to offers. We ask that growers list their 2024 grapes with Ciatti as early as possible, to assist us in finding a buyer. Growers should keep us up to date with the grapes they have for sale by contacting Molly at +1 415 630 2416 or molly@ciatti.com. Potential buyers of grapes trying to get a feel for what is available should also reach out to us.

On what grapes is activity happening?

Activity has mainly occurred on white grapes at relatively low pricing. In the Interior, wineries have been securing some Chardonnay, Sauvignon Blanc and especially Pinot Grigio grapes, as well as some generic whites, and whites for concentrate. Certain whites at certain times were subject to multiple buyer interest, pushing up prices slightly – two developments rarely seen over the past year. It is not known whether this activity has been stimulated by reports of a lower-than-average white grape crop (coming on top of some vine pull-outs), or due to demand pressure from the consumer end. Wine’s current sales performance suggests the former reason is more likely, but sales struggles have not been uniform, with some programs stable or even growing.

White grapes have also led interest in the North Coast. Various buyers have been seeking Sauvignon Blanc, potentially on suspicions of a lighter crop, but with a ceiling on price – Napa and Sonoma Sauvignon Blancs have mainly only been able to command North Coast pricing. This suggests most of this Sauvignon Blanc fruit is needed to fulfil more competitively-priced wine programs. Some – limited – spot market activity has occurred on Chardonnay, but availability remains. Similar activity has occurred on Chardonnay in the Central Coast, where demand for everything else is quiet and grape pricing is, in many instances, below traditional levels. In the Central Coast there are opportunities for buyers to upgrade on quality.

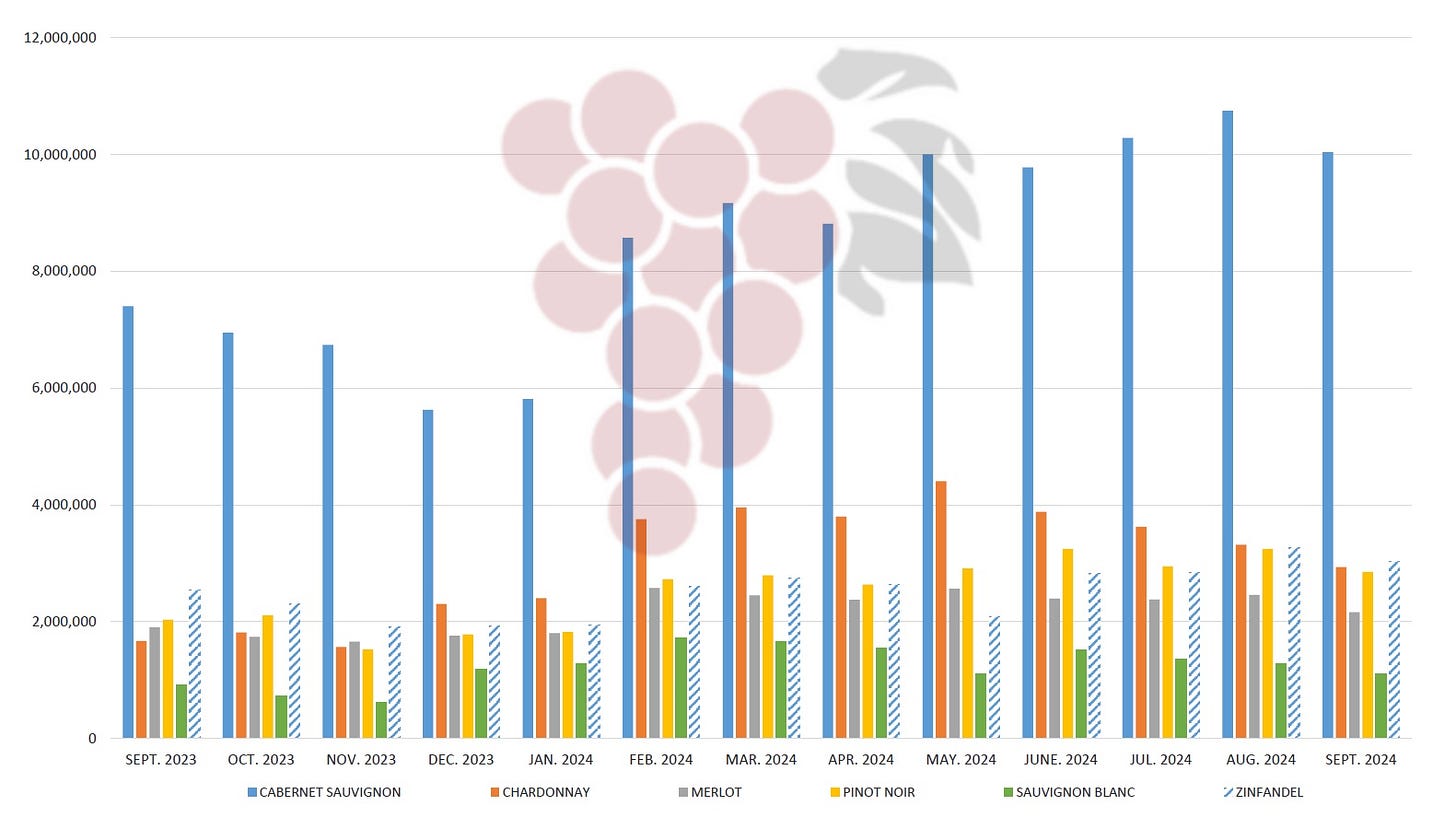

Meanwhile, state-wide, demand for red grapes has been intermittent, for small volumes, and without trend as to variety. As illustrated by this month’s Ciatti bulk inventory chart below, significant reserves of Cabernet and Pinot Noir remain available, disincentivising big moves for the 2024 grapes. Grape pricing has reduced to reflect this, and – particularly on Pinot Noir – has increasingly become homogenized across Coastal appellations. Consequently, there are plenty of high-quality opportunities still available for buyers. If harvest becomes condensed, the later-season reds – namely Cabernet – could benefit if they are the only grapes still waiting to be picked by the time wineries have had time to free-up crush capacity and assess if they need extra fruit, but that remains to be seen.

Recent grape activity across reds and whites corresponds with trends in wine consumption. The latest Winescape report from Terrain-American AgCredit relays Nielsen IQ data showing that, on the US retail market, sales of red wine (-7% in January-June 2024) have been falling faster than sales of white (-4%). Within the white wine category, Sauvignon Blanc and Pinot Grigio sales remain relatively robust but have struggled to offset Chardonnay declines.

The ongoing custom crush dilemma

Should growers custom crush their uncontracted grapes? We believe, given the slowness of bulk wine sales in response to continued slow retail sales, and the low prices many bulk wines are currently fetching, there is a significant risk in custom crushing. Moving into bulk wine should be strategized as a major business diversification, requiring significant capital and resources. With the bulk market slow, and many buyers proceeding on a just-in-time basis between buying and bottling, those who crush must be prepared to store their wines for an extended period, something which incurs extra cost. Wine price expectations must be realistic, using current 2023-vintage pricing as a guide.

With all that considered, it is no surprise we are seeing some grape suppliers accept lower spot-market prices in order to avoid getting involved in the bulk market. Growers are welcome to reach out to us if they wish to understand what the potential pricing may be if they custom crush and, if they do crush, they should let us know so we are ready to help sell the resulting wine as quickly as possible over the coming year.

The Bulk Market

With harvest in full swing, the slight uptick in bulk market activity that we saw from May onward has since fallen back slightly. However, activity levels remain relatively good for the time of year and – given many buyers currently have a strategy of delaying purchases and buying only when they know they definitely need to – there could be another uptick in activity if the crop comes in lighter. Significant bulk wine opportunities are currently waiting on the market to be harnessed; those buyers in a holding position will need to ensure they do not hold off for too long and miss out on the best of those opportunities.

Suppliers, meanwhile, are encouraged to list their wine stocks (of any vintage) with us as soon as possible and send us their samples – especially when requested – if they wish to maximize their chances of making a sale. Suppliers can contact either Mark at +1 415 630 2548 / mark@ciatti.com or Michael at +1 415 630 2541 / michael@ciatti.com to get their wines listed. Buyers requiring wine should get in touch so we can send samples their way.

Much of the bulk activity over the past month has come at heavily discounted prices, but not all sellers are yet motivated enough to sell at such levels. There have been spot transactions – albeit at lower-than-normal prices – on Coastal Cabernet, some of it 2022 or 2023 Napa Cabernet. Inquiries have also come in for cheaply-priced Cabernet from elsewhere in the state, but this supply has been difficult to find, either because stocks in that area of pricing are limited or because – at that price – suppliers would rather keep hold of their wine, gambling on better prices later on.

This applies across the bulk market in general, with many suppliers hesitant to accept prices as low as $0.50-2.00/gallon. Such pricing is not indicative of quality – which is usually high – but the extent of availability and the lack of buyer need: Consequently, these prices are most commonly found on reds, longer in inventory than whites.

Mirroring decent demand levels for Sauvignon Blanc grapes, buyers have been future-contracting 2024 Sauvignon Blanc bulk wine. Similarly, the good recent demand levels on Pinot Grigio grapes in the Interior could translate into 2024-vintage bulk wine purchases sooner rather than later.

Wait for better retail sales continues

Measurements of wine’s performance at US retail continue to be negative, with 2024 as yet bringing little if any sales stabilization, counter to forecasts earlier in the year. The US market is by no means alone: Wine consumption is flat or declining in the overwhelming majority of markets, with the International Organisation of Vine & Wine estimating that global consumption has steadily trended downward since 2017, equating in 2023 to levels last seen in 1996. In response, vineyard removals have been taking place in a number of producer countries, including France, Chile and Australia.

Sales are being squeezed by the twin pressures of reduced consumer spending on non-essential items – in response to post-pandemic inflation – and a generational shift in consumer attitudes toward wine (and the consumption of alcoholic beverages in general). A factor in both is wine’s higher price per alcohol unit versus an ever-proliferating number of rivals. The recent negative health messaging in regard to wine consumption will not have helped, particularly in terms of attracting younger consumers who seemingly are more likely to think wine is – to quote a recent Guardian article on the US market – “stuffy, unhealthy, or just ‘mid’” (i.e., mediocre).

Of particular concern in the recent Winescape report on US market dynamics was its identification of a significant fall in DTC sales via tasting rooms, websites and wine clubs – a part of the market that has, until now, performed a little better and provided many wineries with some much-needed cashflow and margin.

The million-dollar question is: When will a sales stabilization finally occur? Fingers are crossed for the important and imminent October-December sales period, but realistically it is now looking like 2025 at the earliest. An uptick in fortunes could be rapid if case-good sales numbers improve just as acreage continues to be removed – some 30-40,000 acres so far this year, according to a rough Allied Grape Growers estimate, and we expect more removals post-harvest and into 2025. Ultimately, until consumer sales improve, the wine industry’s financial challenges will persist, with any bankruptcies potentially further squeezing industry asset prices and amplifying the burden of inventory on the market.

For Ciatti head office and individual brokers’ contact details, hit this button.

Saxco Update

Welcome to September’s update from Saxco on market dynamics in beverage packaging.

It is harvest season in wine country, beginning with white wines like Sauvignon Blanc. This period is not only one of the most picturesque but also the most hectic in our industry. The urgency of harvest time, which waits for no one, triggers a rush of last-minute requests for wine bottles and packaging, driven by new strategies, increased yields, or fresh plans. All of this activity in the vineyards reverberates throughout the supply chain, reflecting the season’s dynamic pace.

Logistical efficiencies, manufacturing constraints, and increasing demand due to harvest were the theme for August. Ocean freight costs from Asia to the US have recently decreased, with a 4% drop for the West Coast and a 3% reduction for the East Coast, potentially lowering import costs. Meanwhile, Canadian Rail operations are stable, although ongoing Union negotiations could impact future service reliability. However, there is escalating concern over potential disruptions from a projected East Coast Port strike slated for October 1st, 2024, which could hinder port operations and affect supply chains.

On the manufacturing side, major glass manufacturers continue to reduce furnace capacity, which still has the potential to create downward pressure on supply, and could possibly lead to shortages or increased prices in the wine glass market.

Bottled Tidbits - Glass was made by accident! One popular legend suggests that glass was accidentally discovered by Phoenician sailors around 5000 BC. The story goes that they placed cooking pots on top of soda-rich stones on the beach, and when heated by their campfires, the mixture of sand and soda created glass.