Following an October that exhibited summer-like heat spells – including daytime temperatures of 105-106°F and night-times in excess of 75°F – California’s 2024 harvest was essentially complete by November 1st. As well as contributing to a busy end-of-season picking period – and, in turn, some short-term capacity constraints at wineries – the heat is likely to have reduced the final crop size, especially of those (mainly red) varieties still hanging when it arrived.

The crop’s size remains extremely difficult to gauge, owing to the high number of variables: A patchy performance across the state this year, the late heat, uncontracted grapes potentially going unpicked, and vineyard abandonments or removals. In the North Coast, Napa and Sonoma tonnages were down from the average; Mendocino and Lake tonnages were more in line. Cabernet appeared to have suffered one of the larger shortfalls in the North Coast, with Napa and Alexander Valley Cabernet potentially coming in 20-30% lighter than expected.

The Central Coast’s crop was potentially 15-25% smaller than last year. The late heat caused some dehydration and – with processing capacity briefly limited – some weight was lost in the vineyards. The shortfalls appear to have come in greater on the reds and the further south the vines are situated: Paso Cabernet, for example, potentially saw shortfalls beyond 25%, while Chardonnay and Pinot Noir were generally lighter to a lesser extent. The Interior’s crop is expected to have been short of its average by at least 15-25% on the whites and 5-10% on the reds, although the shortfall of some reds – namely Cabernet – appears to be greater due to the heat. In addition, reds were likelier to be uncontracted and left unpicked.

Our state-wide crop guesstimate remains 3.2-3.3 million tons. Some of the discussion we hear is around the possibility of the crop being even smaller, perhaps below the 3-million-ton-mark. However, any extra shortfall caused by October’s heat may have been at least partially offset by fewer grapes being left on the vine, as growers reacted to demand from buyers seeking replacement volumes. Overall, grape quality was high. Harvest weather was conducive throughout and - until the late heat - maturation proceeded steadily, allowing for a straightforward succession of picking. Given October’s heat, some 2024-vintage wines are likely to be characterized by a riper style and fruit-forward notes.

It remains a painful time for the industry. Cashflow, essential for surviving until such time as supply and demand is back in balance, is hard to come by; with asset values having dropped, so too is financing. Consolidation and rightsizing are underway, indicative of financial pressure both in the industry and the wider economy. The coming year will be a telling one: Grape and bulk wine buyers may have reduced their demand in 2024 to offset lingering 2022/2023 bulk inventories – will 2025, as a consequence, mark a return to some market stability?

Ciatti’s broker team – possessing over 130 years of collective wine industry experience – is on hand to help buyers and sellers navigate this challenging time. Read on for the latest crop and market insights, and – for the most up-to-the-minute intel – don’t hesitate to get in touch directly.

To read the full report, simply keep reading below, clicking on images to enlarge them. For Ciatti head office and individual brokers’ contact details, hit this button.

Import tariffs: back on the agenda?

On November 5th, Donald Trump was re-elected as US President. Forming part of his campaign platform was a promise to impose import tariffs on foreign goods, in an attempt to reduce the country’s trade deficit. During the campaign, Trump claimed that his administration would impose a 60% tariff on Chinese imports and a universal 10-20% tariff on imports from all other countries, including those of the EU.

What does another Trump presidency mean for the wine industry going forward? We are in the process of assessing what we can potentially expect, and when. For advice in relation to packaging, please see this month’s Saxco Update below.

Tariffs were imposed on Chinese and EU imports during the first Trump administration. This included – as collateral in the long-running Boeing-Airbus trade dispute – 25% import tariffs on French, Spanish and German still wines from October 2019 until they were provisionally suspended in March 2021. (The EU did not place retaliatory import tariffs on US wines, only spirits.)

As part of the Boeing-Airbus dispute settlement, reached in June 2021, the 25% import tariffs on still wines from France, Spain and Germany were suspended for a period of at least five years. The French federation of wine and spirits exporters – FEVS – said the tariffs had caused US imports of French still wines to drop in value by €400 million in 2020. Import volumes of Champagne and Italian wines – not subject to the tariffs – increased.

The Grape Market

Activity on California’s grape market continued to be limited through October, although projections of a lighter crop and the heat’s arrival stimulated a small uptick, especially on those grapes rumored to have been particularly heat-affected, such as Napa and Paso Cabernet. There was also interest in Coastal Cabernet grapes from outside these areas, and on Zinfandel and some miscellaneous whites. In nearly every instance, on what did sell, pricing was at minimum levels. Buyers sought only to replace shortfalls, often hesitantly. Many are comfortable in going short on 2024-vintage wine supply as they still possess 2023 inventory, and are eyeing 2025 as the year in which their inventory evens-out into a more balanced position.

As the number of vineyards out of contract has risen this year versus last, a greater number of growers will have needed to contemplate custom-crushing their grapes. Some able to afford the risk went ahead and did so, particularly larger players and those in areas like Napa or Sonoma, who might expect a certain level of demand for the resulting wines. Many others will have opted to forego the expenditure of making and storing wine, given the bulk market’s ongoing slowness; some may still possess wines they custom-crushed in 2023. Instead, they left fruit hanging or placed it on the spot market at clean-up pricing. Overall, we suspect that the proportion of growers opting to custom-crush reduced this year compared to last.

Short crop no curative

A smaller 2024 crop, although helpful amid a time of high inventory levels and struggling retail sales, is not the industry curative. Until such time as retail sales start to stabilize, and retailers/distributors consistently require more volume, bulk inventory will remain long and relatively low in price, with all the negative domino effects that has on growers.

In a normal cycle, now would be the time when grape buyers take advantage of some lower pricing by coming in to secure multi-year supply contracts. Indicative of the current health of the bulk wine and retail markets, that is yet to happen. Once retailer/distributor demand improves, the next stage in the recovery should involve a return to pricing that provides a sustainable margin up and down the grape and bulk wine supply chain, so ending the acreage and wider industry contraction.

With downward pressures on grape prices – even when there was spot activity this year, it was often at pricing unsustainable for the grower in the medium to long-term – vineyard mothballing and removal will continue. Adjustments to viticultural management are being undertaken on the more financially viable vineyards to reduce expenditure on them until such time as the grape market revives. The choice of whether or not to remove a vineyard entirely will become even more agonizing once the rationalizing process has completed the removal of the oldest and most obsolete vineyards and moves on to better, younger plots. A key determiner of how much California’s total acreage will reduce by, and for how long, will be what the vines get replaced by: New vines, an alternative agricultural crop, or another purpose altogether? Most removals are unlikely to be temporary, given the ever-increasing cost of planting. Contracts for planting are currently few and far between.

2025 grape interest

We have already received some buyer inquiries into 2025 grapes. Growers are therefore invited to let us know what grapes they may have available next year, by contacting Molly at +1 415 630 2416 or molly@ciatti.com. Potential buyers of grapes trying to get a feel for potential availability in 2025 should also reach out to us.

The Bulk Market

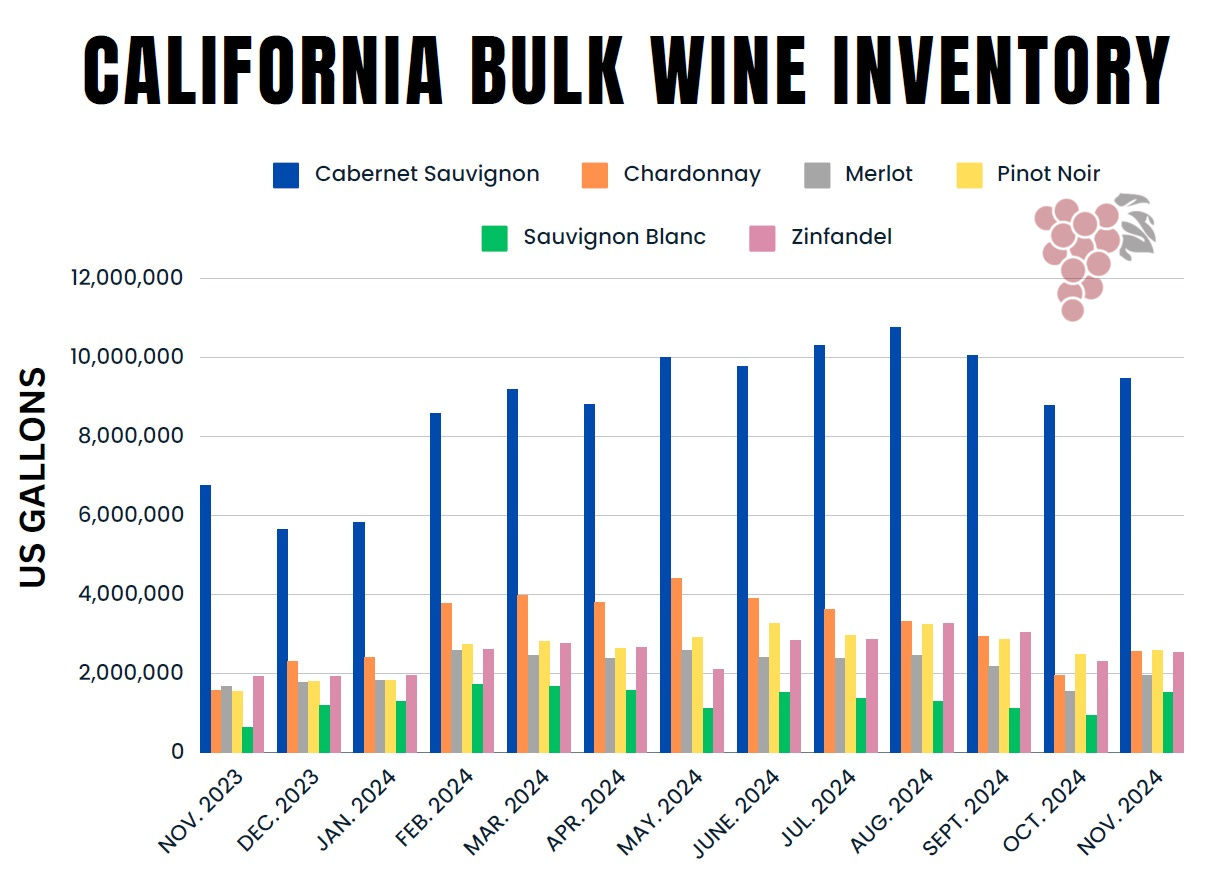

Coming into November, California’s total bulk wine inventory level is significantly higher than it was 12 months before, and inventory of every major varietal is larger to varying extents. Cabernet dominates, representing approximately a third of total availability.

Suppliers are completing their winemaking while potential buyers are assessing the options stemming from the crop. Buyers are likely to move onto the market only when they are definite there is a need to fulfil, as holding inventory is currently viewed as a liability – both by themselves and their lenders. However, considering buyers have been rightsizing their inventories over the past 12-18 months, they should now be in a better supply-demand balance; many will need volume.

White wine sampling underway

Samples of 2024 varietal whites have been coming in and there have already been some transactions resulting from these. Activity across the state has so far been white varietal-focused, with smaller, spotty deals on other items; much of the activity is discussion. The sluggishness of wine demand means that, despite the shorter crop, many of the white-wine deals that have so far taken place have been at pricing in line with 12 months ago.

Buyers seeking 2024-vintage whites should get in touch as we are ready to supply samples or host tastings. Similarly, those who have, or will have, wines for sale – red or white, 2023 or 2024 – should list them with us as soon as possible, and send in samples. The buying chain – from the retailer to the distributor to the winery – is operating on a just-in-time basis: When wines are needed for bottling, they are often needed fast. Therefore, listing your wines with us and providing samples means we are ready to harness buyer interest when it arises. Suppliers can contact either Mark at +1 415 630 2548 / mark@ciatti.com or Michael at +1 415 630 2541 / michael@ciatti.com.

We expect to see some renewed interest in 2023-vintage reds as the year draws to a close, considering the relative lightness of the 2024 red-grape crop. There has been some limited demand for 2022 and 2023 Alexander Valley Cabernet and 2023 California Pinot Noir.

NielsenIQ data for domestic wine sales at US retail remains concerning – volumes were down 6% for the 52 weeks to September 7th – but we are hearing anecdotally of some better sales numbers for wineries in recent weeks. Due to the just-in-time business model that is becoming the norm, demand for bulk wine is often intermittent, making it more difficult for suppliers to feel good about demand levels, even when there is some. That said, whether or not retailer/distributor destocking has ended and volume needs are returning to something like normal remains to be seen. The all-important October-November-December sales period will be telling: It is hoped that, even if there is no big upswing in consumer demand for wine, retailers/distributors are now back in some sort of inventory balance and will require more wine due to the festive season.

Buyers seek 23 opportunities

Indeed, we have seen a few buyers come onto the bulk market seeking to fulfil some larger private-label programs – mainly negociants seeking 2023 premium-appellation wines at value pricing. With inventory large and pricing softer than in previous years, there is a wide range of such opportunities available for buyers who have the capability to harness them. As we observed last month, the state’s pricing hierarchy is deflating toward California appellation levels, a process particularly painful for mid-market and high-end wines outside of popular cachet items like Napa Cabernet or Russian River Pinot Noir.

Meanwhile, at the other end of the market, supply of bulk wine at the $1-2/gallon level has reduced. For example, Interior availability of $1/gallon Dry Red and Dry White has become difficult to find. This is perhaps due to such wines having sold through – assisted by the shortness of the 2024 crop – and/or suppliers potentially becoming a little more bullish on price. Bottom pricing can therefore be said to have firmed-up slightly.

For Ciatti head office and individual brokers’ contact details, hit this button.

Saxco Update

Welcome to November’s update from Saxco on market dynamics in beverage packaging.

With a challenging harvest, ongoing industry headwinds, and the recent resolution of the US election, the world is still adjusting to what has become a continuously evolving “new normal” since COVID-19. The supply chain now braces for potential uncertainties surrounding a new administration.

Concerns about rising fuel expenses are becoming more pronounced, with diesel prices experiencing a modest increase of approximately three cents on average across the US, as reported by the EIA. This uptick is causing anxiety among businesses that rely heavily on transportation to maintain their supply chains. On a more positive note, there is significant relief in international shipping. The cost of ocean freight from Asia to the US has seen a remarkable decline, with container shipping fees plummeting by $1,000 to $2,000.

The International Longshoremen’s Association recently conducted a brief but impactful three-day strike at ports along the East and Gulf Coasts. This work stoppage concluded with a tentative wage agreement, extending the existing contract until January 15th. Jonathan Gold, Vice President for Supply Chain and Customs Policy at the National Retail Federation (NRF), warns that although this strike was resolved quickly, the potential for a more prolonged strike looms if a new labor contract is not secured by January. In anticipation of possible future disruptions, companies are taking pre-emptive measures. Many are expediting their shipments and redirecting cargo to West Coast ports as a strategic move to avoid expected congestion and delays that could arise from ongoing labor negotiations. These proactive steps reflect the ongoing uncertainty in the supply chain landscape.

A persistent issue is the ongoing closure of glass furnaces. O-I has shuttered its Illinois plant and R&D center, adding pressure on glass supply. However, there is some good news: Arglass has opened a new facility with a beer bottle-focused furnace in Valdosta, Georgia. With significant leadership changes among major glass manufacturers, it is yet to be seen if these new executives will bring fresh strategies or continue with the status quo.

While the election’s impact on tariffs remains unclear, it’s essential for anyone sourcing international glass to consider alternative US suppliers or secure guaranteed imports, especially given the uncertain trade landscape with key countries like China and Mexico.

Bottled Tidbits - Meet Sir Kenelm Digby, a true historical maverick. Haunted by the memory of his father, executed as a co-conspirator with Guy Fawkes, Digby carried what he called a “stain on his soul.” But his life was anything but ordinary. As a licensed privateer (a pirate with a royal seal of approval), he escaped a forced marriage to a French princess and poured his energy into an eclectic array of pursuits. A natural-born polymath, Digby wrote a book of bizarre remedies, including a plague “cure” mixing sherry with sheep stomach contents and a headache remedy – “Viper Wine” with real venom – which tragically proved fatal for his wife.

Digby’s curiosity only grew, leading him to co-found the Royal Society. Teaming up with Admiral Sir John Mansell, a scheming MP and coal magnate, the two orchestrated a crafty plan. Mansell passed a law that banned wood-fired furnaces to “save trees for the Royal Navy,” conveniently driving the glass industry to rely on his coal. Digby developed a new glass formula to meet the coal's higher heat, resulting in far sturdier bottles.

Meanwhile, fellow Royal Society member Christopher Merret was experimenting with wines, discovering that adding sugar and molasses made wine sparkle. With Digby’s durable bottles, Merret’s sparkling wine idea became feasible, setting the stage for the world’s first sparkling wine. Together, Digby and Merret’s innovations reshaped wine forever, creating a legacy that still sparkles today.